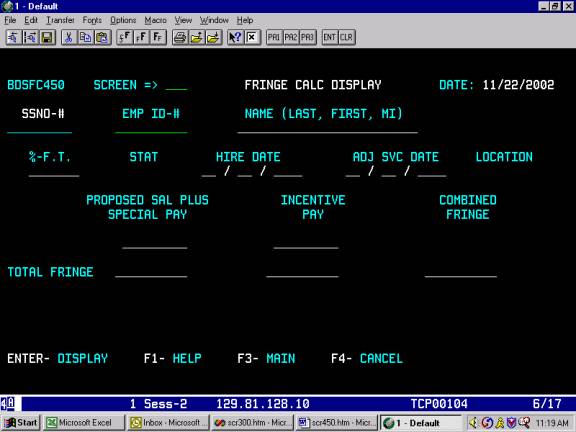

FRINGE CALC DISPLAY (Screen 450)

This is an information only screen.

It displays the FRINGE amount calculated for the employee’s BASE salary

information (PROPOSED SALARY plus SPECIAL PAY) and INCENTIVE pay (if

applicable) budgeted on Screen 400. The PROPOSED SALARY and SPECIAL PAY amounts

are added together and will display under the PROPOSED SAL PLUS SPECIAL PAY

heading. Tulane paid INCENTIVE PAY

(Natural Account 5241) amounts are added together and will display under the

INCENTIVE PAY heading. (See Appendix A

for the FRINGE CALCULATION schedule.)

On the line identified by TOTAL FRINGE, you will see the fringe amounts

listed for the BASE salary and/or INCENTIVE respectively, and the COMBINED FRINGE

total under its heading. You may only

see the BDS employee/position information you have been authorized to

update/view. To go to Screen 450, move your cursor to the SCREEN=> field:

- Type 450

and press ENTER/RETURN.

Figure

K-1: Fringe Calc Display Screen

You will

see Screen 450 - FRINGE CALC DISPLAY (See Fig. K-1, above). The FRINGE calculates automatically in BDS. The FRINGE table looks at

the PROPOSED SALARY, any SPECIAL PAY, and any INCENTIVE (Natural Account 5241)

amount, and calculates the related cost based on the fringe rate for the

position's location code (See Appendix A).

If you are looking at an employee/position's

record on another screen, BDS will carry the selected position's record to

Screen 450. You have the capability to see other employee/position FRINGE

information by entering the desired position's identification number in the

EMPLOYEE ID-# field and pressing ENTER/RETURN.

The FRINGE information is displayed for the

position's PROPOSED SALARY, SPECIAL PAY (if applicable) and/or INCENTIVE

(Natural Account 5241) amounts (if applicable) and a COMBINED (total) FRINGE.

The FRINGE information consists of the following categories:

THE BASE SALARY AND/OR INCENTIVE PAY FOR

THE EMPLOYEE/POSITION. BASE SALARY is equal to the PROPOSED SALARY

plus any SPECIAL PAY. Any INCENTIVE PAY

is equal to the total of FPP Supplemental Wages (Natural Account 5241).

A FRINGE RATE BASED ON THE

EMPLOYEE’S/POSITION’S LOCATION CODE. A fringe rate is assigned to each location

code. An employee’s/position’s code is

made up of two (2) fields: CAMPUS and EMPLOYEE TYPE. The CAMPUS codes are: UP, MC and PR. The EMPLOYEE TYPE codes are: AD, FA, ST, SD, PH, PF, PS and PD. The SD code is only used for vacant

positions, which budget salaries for students. FPP SUPPLEMENTAL WAGES (Natural Account 5241) have a rate assigned

and location codes do not affect the calculation of their fringe amounts. (See Appendix A).

BASE SALARY FRINGE AMOUNT. This

is calculated by multiplying the BASE SALARY by the appropriate rate for the

employee/position’s location code.

INCENTIVE PAY FRINGE AMOUNT. This

is calculated by multiplying the FPP WAGES by the rate for FPP WAGES.

Other Function Keys Available on This

Screen:

ENTER - DISPLAY. This function key will activate the identification

number search for the number you entered on the EMP ID-# field. It will also

move you and/or your selected employee/position to another screen when a screen

number is entered in the SCREEN => field.

F1 - HELP. This function key displays an explanation of all

fields on this screen.

F3 - MAIN. This function key will bring you to the BDS MAIN

MENU screen.

F4 - CANCEL. Clears and resets all the screen fields for entry

of the next individual/position ID #.